by ABS Professionals | Sep 9, 2015 | Accounting & Taxes, Blog

While there are many Tax Returns (T1 & T2), Accounting, Bookkeeping and Business service providers offering their services in Alberta specially in Edmonton, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada but none can match Accountable Business Services (ABS) ABSPROF unique combination of experience, expertise and personalized service on very affordable rates.

Our expert team of accounting and other financial services have decades of experience in the business (both corporate and proprietor/partnership) and financial services industry. We are able to draw from that experience to help your business become more efficient and make more money.

Our expert team of accounting and other financial services have decades of experience in the business (both corporate and proprietor/partnership) and financial services industry. We are able to draw from that experience to help your business become more efficient and make more money.

We take the time to fully understand your business, and to show you how to use your financial information to make smart and timely business decisions. We’ll also help you determine the level of service that’s right for you and ensure that you only pay for the services you require.

(more…)

by ABS Professionals | Sep 1, 2015 | Blog, Bookkeeping

Accountable Business Services (ABS) ABSPROF is an Alberta based Accounting, Bookkeeping and Tax preparation and Filing Firm operating from Edmonton, Alberta. We have an experienced team of Professional Bookkeepers, who provide Accounting and Bookkeeping Services to Small Businesses in Edmonton, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada at affordable price.

Our team is client focused. We believe that the most significant component of our business is our relationship with our clients. We contact with our clients to realize their business demands. Through this understanding, we are able to design individualized services to meet all our customer’s accounting needs.

Our team is client focused. We believe that the most significant component of our business is our relationship with our clients. We contact with our clients to realize their business demands. Through this understanding, we are able to design individualized services to meet all our customer’s accounting needs.

(more…)

by ABS Professionals | Aug 27, 2015 | Blog, Farm Taxes

Whether you’ve children or not, September always brings thoughts of school, changing seasons and fresh showtimes. So, Taxes (T1 & T2) may be the last thing on your mind. That’s why Accountable Business Services (ABS) ABSPROF is here; to always be working to make your life less Taxing (T1 & T2) and put more income in your pouch.

The Autumn is a pure time to meet with a Tax Consultant to recap the current Tax year and have a Tax (T1 & T2) Plan that can assure you time any Business decisions to put you in the best Tax position for your 2015 Tax (T1 & T2) Return.

The Autumn is a pure time to meet with a Tax Consultant to recap the current Tax year and have a Tax (T1 & T2) Plan that can assure you time any Business decisions to put you in the best Tax position for your 2015 Tax (T1 & T2) Return.

Accountable Business Services (ABS) ABSPROF offers Tax Planning, Preparation and Filing Services to the Farm and Small Business Owners in Alberta specially Edmonton Area, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada on a least price.

(more…)

by ABS Professionals | Aug 20, 2015 | Blog, Cloud Technology

Some Small Business Owners do their own Accounting, but others hand their records off to an Accounting and Tax Services experts. Someone who is trained in Accounting and knows what to look for can you save time, money, and frustration. But even the best Accounting and Tax Services experts need information and records from you.

When you submit your business records to your Accounting experts, do you give them digital files with all the information neatly organized, or do you hand over a box of loose papers and receipts and expect them to sort it out? If your records aren’t digital, it could be costing you.

When you submit your business records to your Accounting experts, do you give them digital files with all the information neatly organized, or do you hand over a box of loose papers and receipts and expect them to sort it out? If your records aren’t digital, it could be costing you.

Keeping clear, concise, and organized digital records allows you to:

Quickly retrieve your data and create accurate reports: Making a report from paper records can take weeks. With Accounting softwares like (QuickBooks, Xero, FreshBooks & Sage 50 Accounting), you can get the information you need presented to you in an easy-to-understand format within minutes. Spend less time waiting on reports and more time analyzing and acting on the information to improve your business.

Spend less money on accounting fees: Whether you’re hiring a private Accounting and Tax Services expert or have one on staff, clean digital records or Paperless records means less billable time is wasted. Your Accounting expert will spend less time focusing on getting your records in order and more time discussing the content. This means your Accounting and Tax Services Firm can spend more time showing you how your business can save money and avoid pitfalls in the future.

Reduce document storage fees: Businesses must keep Tax records and other financial documents on hand for a minimum of seven years. Many business owners opt to keep them much longer. In addition to financial records, some industries require businesses to store extensive records about clients. Keeping paper files takes up valuable floor space. You could easily replace an entire room full of paper files with one database on your computer.

Keep your business’s financial information more secure: In today’s world of high-profile hacking scandals, it might seem counterintuitive, but digital records are actually more secure than paper files. With paper records, anyone with access to the files can simply open them up and read them. You can encrypt digital files and limit data access to authorized users, so the data is only available to those who need it.

Get up to speed quickly in the event of data loss: Natural disasters, fires, and other unforeseen events can wipe out paper records. With digital files, you can keep your backups offsite. If your computer crashes or disaster hits, you won’t be dead in the water. Simply install the software on a new computer and restore the records, and your business can be up and running within a few hours.

(more…)

by ABS Professionals | Aug 13, 2015 | Blog, Cloud Technology

A Paperless Office Environment is work surroundings in which the use of paper is eliminated or greatly reduced. This is done by converting documents and other papers into digital form. Advocates claim that “going paperless” can save money, boost productivity, save space, make documentation and information sharing easier, keep personal information more secure, and help the environment. The concept can be extended to communications outside the office as well. It is very easy to recover your documentation for Canada Revenue Agency (CRA) Review and for your business purposes.

Accountable Business Services (ABS) ABSPROF is an Accounting and Tax Preparation & Filing, Bookkeeping and Payroll service provider firm provide Paperless Office Environment for Accounting and Tax Services in Alberta specially Edmonton Area, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada that merges comfortable, personal service with the advantages of leading-edge technology.

ABS ABSPROF specialize in creating a “Paperless” Accounting Environment through online systems that increase efficiency and productivity while helping to reduce reliance on paper reports, files and forms. Accountable Business Services (ABS) ABSPROF practice size enables it to provide the highest level of service at rates that will fit most budgets.

ABS ABSPROF specialize in creating a “Paperless” Accounting Environment through online systems that increase efficiency and productivity while helping to reduce reliance on paper reports, files and forms. Accountable Business Services (ABS) ABSPROF practice size enables it to provide the highest level of service at rates that will fit most budgets.

While it takes some getting used to, we guarantee that going Paperless Office Environment will save you a whole lot of time and hassle during Tax (T1 & T2) season and throughout the year. No matter if your Business is brick-and-mortar, or if you’re an office-less entrepreneur, as long as you’ve got a smartphone, a laptop, and access to the internet, here’s how you can make your Business semi- or fully- Paperless, too.

(more…)

by ABS Professionals | Jul 31, 2015 | Accounting & Taxes, Blog, Farm Taxes

Accountable Business Services (ABS) ABSPROF works exclusively with Dairy Farmers performing dairy and Agriculture Accounting. We realized that there was a fantastic need by the Dairy Farm community for exact Farm Records, Bookkeeping, Payroll Assistance, and Tax Planning, Preparation and Filing. Without appropriate records and financial statements, many in the dairy industry struggled to obtain much needed financing to maintain or expand their operations. ABS developed a very unique niche in the market and filled the gap that our clients urgently demanded to succeed.

Accountable Business Services (ABS) ABSPROF offers Farming and Agriculture, TaxPlanning, Preparation and Filing Services in Alberta specially Edmonton Area, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada on a very low cost.

Accountable Business Services (ABS) ABSPROF offers Farming and Agriculture, TaxPlanning, Preparation and Filing Services in Alberta specially Edmonton Area, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada on a very low cost.

Accountable Business Services (ABS) ABSPROF is more than the typical Accounting firm. While we do provide traditional Accounting Services, we also offer other business consulting services to clients throughout Canada. Our experienced team strives to become trusted business advisers by guiding clients throughout their business lifecycles. We serve companies across various industries by providing proactive, groundbreaking and extensive solutions. At Accountable Business Services (ABS) ABSPROF we believe building trust with our Farming and Agriculture Clients are essential to helping them reach their goals.

(more…)

by ABS Professionals | Jul 27, 2015 | Blog

If you are concerned in working with an Edmonton, AB, Business Taxes (T2) Preparation and Filing Services that’s centered on client expiation, then Accountable Business Services (ABS) ABSPROF is here to help. We’re a locally owned and operated Business with several years of industry experience, and regardless of the extent of our clients’ financial troubles, we’ll work hard in an effort to exceed their expectations. Accountable Business Services (ABS) ABSPRFO offers Business Taxes (T2) Preparation and Filing Services in Alberta; including, Edmonton, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada on really affordable price.

When our highly experienced and detail-oriented Business Taxes (T2) Preparation and Filing team are on a job, they make a point of quickly and comprehensively addressing any questions and concerns you might have. We’re wishing to work around your schedule and even travel to your place of Business. With all these marvelous profits and more, you can know you’re in for a fantabulous client experience if you decide to work with us.

When our highly experienced and detail-oriented Business Taxes (T2) Preparation and Filing team are on a job, they make a point of quickly and comprehensively addressing any questions and concerns you might have. We’re wishing to work around your schedule and even travel to your place of Business. With all these marvelous profits and more, you can know you’re in for a fantabulous client experience if you decide to work with us.

Canadian Business Taxes (T2) Preparation and Filing Services

Virtually everything you do has Tax deductions and every year, Tax laws and interpretations change and become more colonial. That’s why it is important to consult with a team of Tax advisors who can help ascertain you not only follow with these laws but that you maximize the returns to your Business. Working with you one-on-one, ABSPROF Business Taxes (T2) Preparation and Filing Services team takes the time to understand your Business and delivers a full suite of Services to meet your Business’ needs.

(more…)

by ABS Professionals | Jun 18, 2015 | Blog, Farm Taxes

Are you in search of a reliable and experienced Farm Taxes (T1 & T2) Preparation and Filing Services? Have you had problems in the past with large chain tax shops that lack personal service or operations that seem to only pop up around tax time?

Accountable Business Services (ABS) ABSPROF is here to help. Our firm offers the personal attention that you expect, and we have over several years of experience, so you can put your trust in our knowledge.

Accountable Business Services (ABS) ABSPROF has been locally owned and operated in Alberta Edmonton. We also offer services for St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada at very very affordable price. ABS specializes in Personal (T1), Corporate (T2), Farm, and Estate Tax Preparation Services. We would love to meet you and show you the ‘ABS Difference’!

We recognize farmers. And we experienced in Farm Taxes. For several years, we have been serving farmers like you, to optimize Taxes and maximize credits available through government farm support programs.

We recognize farmers. And we experienced in Farm Taxes. For several years, we have been serving farmers like you, to optimize Taxes and maximize credits available through government farm support programs.

We can help you apply for and process claims for most of the federal and provincial programs that manage your farm risk like; Growing Forward 2, Agriculture Invest, Agriculture Stability, Agriculture Insurance and Agriculture Recovery.

We keep current on government Tax laws and programs affecting farms and can advise you on actions needed to get the full benefit from any government changes. If you have a valid farming business you can use the cash method of accounting for your Tax reporting. It’s a simple system in which you report income in the fiscal period in which you receive it and deduct expenses in the fiscal period you pay them.

(more…)

by ABS Professionals | Jun 16, 2015 | Blog

The Excise Tax Act (ETA) generally allows Tax payers to recover Tax received for the purpose of making Taxable supplies. As Tax Preparation and Filing expert Accountable Business Services (ABS) ABSPROF are often asked to review the allocation method used to allocate Input Tax Credits (ITC) between commercial and non-commercial activities. The ETA requires that the apportionment method used be fair and reasonable and used consistently throughout the year. The Act, however, does not prescribe any particular method for allocation, leaving it up to the registrant to determine how to allocate between these two activities. Moreover, the courts have held that the registrant can choose any method that is “fair and reasonable”, even if another method might be fairer or more reasonable.

The issue of apportionment has always been combative as a small change in the allocation can result in large reassessments or refunds. During the 2006 CICA Commodity Tax Symposium, the CRA announced it would no longer allow ITCs for past reporting periods based on a change in allocation method, much to the surprise of the attending Tax experts. The CRA’s policy was that unless an error had been made, once a fair and reasonable allocation method had been applied to a particular year, the Taxpayer could not retroactively change that method for another, more favorable method and claim additional ITCs.

(more…)

by ABS Professionals | Jun 11, 2015 | Blog, Cloud Technology

We remember the day we went paperless.

Staring at us was a stack of our client’s Tax (T1 & T2) Receipts, Invoices, and countless Journals, the same pile we’d rifle through in anxiety every time a Tax (T1 & T2) deadline rolled around of our clients.

It took us hours of time, a ruthless mindset, and more caffeine than we would like to admit, to sort, upload, and store everything online. But once we would finish, the result was pure relief.

Years later, we still run our Tax Prep and Accounting Services Business entirely from the Cloud. We can’t remember the last time we wasted money on a printer, we travel light (no training manuals stuffed into my carry on), and whether we are out of the office for a quick meeting with our clients or working from a different country, we can access, search, and share all of our documents with teammates and our clients, in just a few clicks.

Years later, we still run our Tax Prep and Accounting Services Business entirely from the Cloud. We can’t remember the last time we wasted money on a printer, we travel light (no training manuals stuffed into my carry on), and whether we are out of the office for a quick meeting with our clients or working from a different country, we can access, search, and share all of our documents with teammates and our clients, in just a few clicks.

While it takes some getting used to, we guarantee that going paperless will save you a whole lot of time and hassle during Tax (T1 & T2) season and throughout the year. No matter if your Business is brick-and-mortar, or if you’re an office-less entrepreneur, as long as you’ve got a smartphone, a laptop, and access to the internet, here’s how you can make your Business semi- or fully- paperless, too.

(more…)

by ABS Professionals | Jun 6, 2015 | Accounting & Taxes, Blog

Accountable Business Services (ABS) ABSPROF is; an Accounting & Tax Solutions provider based in Edmonton, Alberta. We are a fully virtual, 100% Cloud-based, 100% Paperless Accounting service. By combining the state of the art Cloud Accounting Software and a modern mindset, we help move your accounting out of the dark ages and into the future. Expect convenient and accessible service thanks to the power of the Cloud. As your Cloud Accounting experts we are here to save you from your accounting worries.

Accountable Business Services (ABS) absprof offers services in Alberta including Edmonton, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada at very affordable rates.

Our aim is to reduce the burden of critical non-core functions by managing them in a more efficient, productive, and profitable manner. By doing so, we seek to support and enhance the business performance of our customers.

Our aim is to reduce the burden of critical non-core functions by managing them in a more efficient, productive, and profitable manner. By doing so, we seek to support and enhance the business performance of our customers.

Managed Accounting with us is cost efficient. You get a dedicated team for similar or less than what it would normally cost to hire one in-house book keeper. Accountable Business Services (ABS) absprof started with an idea of providing financial expertise to Small, Medium and large-size Businesses.

(more…)

by ABS Professionals | Jun 5, 2015 | Blog

Choosing the right Accounting & Tax service is one of the most important decisions you will make for your business; like Mortgage Brokers. In order to compete effectively in today’s challenging business world, you need an Accounting and Tax service that is dedicated to becoming an integral part of your organization.

Accountable Business Services (ABS) is that eminent Accounting & Tax Solution Provider.

Accountable Business Services is a team of highly dedicated accounting experts to assisting clients to grow their business like Mortgage Brokers, increase their financial net worth and achieve their specific goals. We provide exceptional service in an innovative, competent, courteous and responsible manner.

Accountable Business Services (ABS) has gained the reputation as one of Edmonton’s leading Accounting & Tax service provider. We have achieved this by building and maintaining excellent long-term relationships with our clients. Accountable Business Services (ABS) offers Tax (T1 & T2), Accounting Bookkeeping Services in Alberta, Edmonton, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada on Elfin (Small) Price.

Accountable Business Services (ABS) has gained the reputation as one of Edmonton’s leading Accounting & Tax service provider. We have achieved this by building and maintaining excellent long-term relationships with our clients. Accountable Business Services (ABS) offers Tax (T1 & T2), Accounting Bookkeeping Services in Alberta, Edmonton, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada on Elfin (Small) Price.

(more…)

by ABS Professionals | May 30, 2015 | Blog

As a professional Trucking Business Owner and Truck Driver, you know that there’s a lot more to the industry than sitting behind the wheel of a big rig. Driving an 18-wheel vehicle is no easy task on its own, but there’s a host of other things to be mindful of besides getting to and from your destination safely.

Compliance is perhaps the biggest of them all. The truck carrier profession can often seem like one big regulation. In fact, on May 5th 2015, yet another regulation went into effect called eManifest. Any company that is bringing cargo from the U.S. now has to inform the Canada Border Services Agency (CBSA) of what’s coming and when it will be arriving.

Fortunately, CBSA has set up a web portal that allows carriers to transmit this information electronically to help cut down on paperwork, but you should still have a hard copy of the transaction so that you have a paper trail.

Bookkeeping for Trucking Business Owner and Truck Drivers

Bookkeeping for Trucking Business Owner and Truck Drivers

Bookkeeping is part of the deal when it comes to the commercial driving profession. But you can prevent it from becoming a chore by establishing a smart system.

The following are a few tips for how to develop a reliable and efficient system you can take with you when on the road, as truckers by their very nature are always on the move:

1. Keep a File Folder in the Truck

Paperwork is a lot like socks: It’s bound to get lost when not kept together. Instead of tossing your receipts and documents on the passenger seat, have a folder so that you can keep everything you have in one place. Alternatively, you may want to color code your folders as shown in the below picture. For example, you could have a red folder for all receipts and a blue-colored folder for all invoices.

Color coding your folders is a smart way to keep track of various records.

2. Take the Folder with You

If you always have a folder in the Truck, you’ll never have to worry about misplacing it or risk it getting lost. However, by doing this, you have to be sure that the first thing you do is transport the documents and receipts to a safe place after returning from a trip, like a filing cabinet or bin.

3. Record Everything

When Tax Filing season comes, you’re going to want to have as many deductions as possible to take advantage of. But you’ll only be able to get them if you have a track record of your expenses.

Whether it’s filling up the tank, association dues or the fee paid after getting a medical exam, have a hard copy of all financial records, making sure to date them as well.

Take Advantage of Online Solutions

The Internet has made the daily grind a whole lot easier for Truck Drivers with such things as the ability to quickly find directions and alternative routes to parts unknown.

It’s also made Bookkeeping much simpler as well thanks to digitization. A digital bookkeeper will help you keep everything in one convenient place – your wireless device. In short, it prevents you from dealing with extra paperwork and receipt overload. It’s all at your e-fingertips.

Accountable Business Services (ABS) ABSPROF has just the thing you need for digital bookkeeping. Just ask an ABS Tax specialist about easy recordbooks. You’re sure to be impressed by what it has to offer.

Making sense of the data you’ve kept is a task unto itself when Taxes need to be done. Let the specialists at ABS handle the work for you. For more information, Contact with an ABS Tax specialist on our Toll Free Number: 1 (888) 556-7864

Contact Details

Accountable Business Services 9905 104 St NW T5K 2G5 Edmonton

Support Call: 1 (888) 556-7864

Fax Number: 780-669-7960

E-Mail: [email protected]

Website: https://absprof.com/

by ABS Professionals | May 30, 2015 | Blog

When a Business launches, the only thing that clients need to see in order to know that it’s there is some signage and an entrance. But there’s more to the story for the people who start the Business and are responsible for its everyday dealings.

Before brand messaging, inventory and profit margin are taken into account, there’s the registering and Business classification to consider. And one of the more popular Business entities in Canada – and the world at large – is the Partnership.

A Business Partnership is self-defining – it’s where two or more people combine their resources in order to form a single unit.

Generally speaking, partners commit an equivalent amount of their capital, or however much parties agree to, and in exchange, get a portion of the proceeds that the business makes in profit. They also agree to share whatever losses are experienced, in colligation with their stake in ownership.

Generally speaking, partners commit an equivalent amount of their capital, or however much parties agree to, and in exchange, get a portion of the proceeds that the business makes in profit. They also agree to share whatever losses are experienced, in colligation with their stake in ownership.

(more…)

by ABS Professionals | May 22, 2015 | Blog

Accountable Business Services (ABS) ABSPROF is an Edmonton, Alberta based Bookkeeping Services geared to Small Business enterprisers looking to outsource their Bookkeeping needs. Edmonton is Canada’s fastest growing financial center. Each year more and more people decide to go into business for themselves and we specialize in small business start-ups. Accountable Business Services (ABS) ABSPROF Bookkeeping is committed to offering a high quality, experience service that is custom-tailored to your specific needs.

Most small business owners try and do it all themselves. This can happen for a number of reasons: limited income, unawareness that outside assistance is necessary, or the “I can do it all” mentality. One question we ask all potential clients is “Do you want your business to run you or do you want to run your business?” If the answer is that you want to run your business then we can guarantee you will need more than just the resources you have at hand to make it happen.

Most small business owners try and do it all themselves. This can happen for a number of reasons: limited income, unawareness that outside assistance is necessary, or the “I can do it all” mentality. One question we ask all potential clients is “Do you want your business to run you or do you want to run your business?” If the answer is that you want to run your business then we can guarantee you will need more than just the resources you have at hand to make it happen.

Accountable Business Services (ABS) ABSPROF offers Bookkeeping for Small Business in Alberta specially Edmonton Area, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada on affordable price.

(more…)

by ABS Professionals | May 13, 2015 | Accounting & Taxes, Blog

It’s no secret that many of you would rather squeeze your eyes out rather than spend one extra minute on your Accounting. It’s time-sucking, administrative and takes away from your focus on the big picture. With the correct tools in place whilst, you can make your life a whole lot easier.

Still stuck using some old, obsolete, frightful looking piece of desktop Accounting Software when managing your financial affairs? It’s time to upgrade. Let’s have a look at the best online Accounting Software for your small business.

Accountable Business Services (ABS) absprof wanted to give a brief update about what we feel is the best online Accounting Software for small businesses in terms of:

- Simplicity and ease of use

- Scalability (i.e. can your system grow with your business)

- Level of automation

- Amount of useful financial insight that can be derived

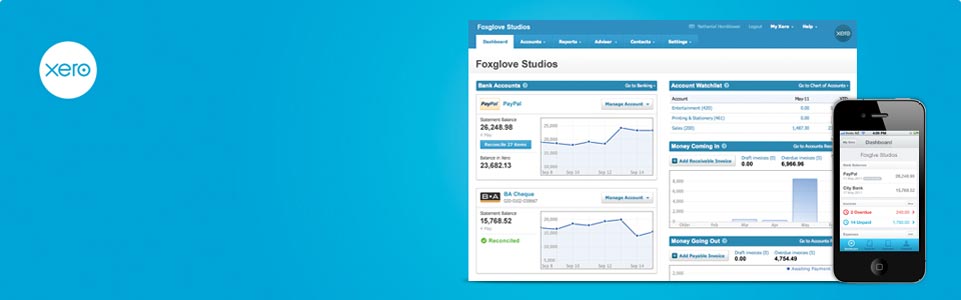

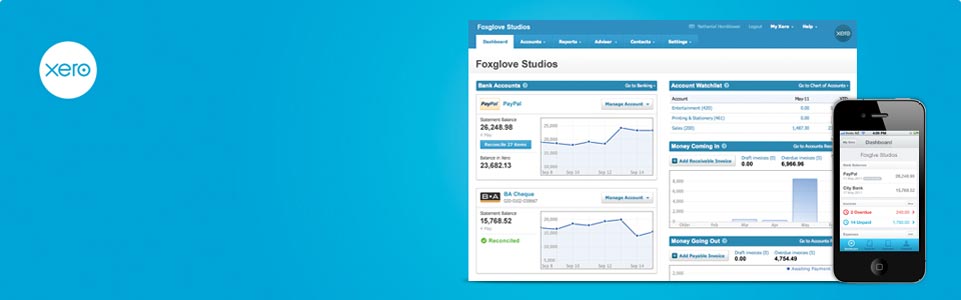

1. Xero

Xero’s appeal lies in its simplicity and in its ease of use. Does it have every single possible feature that an Accounting System should have? No. Xero was not designed to have a billion features. Instead, Xero was designed to act as a very strong core for all Accounting related functions.

For things that Xero cannot accomplish, it has a pretty deep marketplace of third party integrations that allows you to integrate different web apps into Xero. The benefit there is that you can come up with a pretty modular approach to your Accounting depending on what your business processes look like. Xero recognized that you can’t be everything to everyone and as such they focus on the perfecting the core Accounting functionality that every business needs. Anything that’s needed over and above that can likely be found via a third party app that would integrate into Xero. The cool thing about that is that you can always change your system as your business grows.

These days, everyone is trying to automate everything. Xero is no different in that they are trying to automate as much of the Accounting process as possible. By connecting to your bank and credit card accounts, much of the manual data entry can be eliminated as Xero automatically sucks in these transactions. Other automation features include automatically emailing out recurring invoices to clients, speeding up collections and automatically marking sales invoices as paid through a Stripe or Paypal integration, auto-reconciliation possibilities with certain transactions, creation of bank rules to automate transaction classifications and a whole lot more.

Additionally, from an Accounting point of view, the collaboration that we have with our clients is much easier through some of the features that Xero provides us with. We can have certain discussions in-app rather than having to go back and forth by email for instance. This interprets to increased time savings for businesses due to the voiding of email communication for more detail oriented items. Any time email can be eliminated, both parties come out happy.

Canadian businesses will have to settle for a global version of Xero, but with a bit of configuration, the system is perfectly suitable for Canadian purposes.

QuickBooks Online

Intuit, creator of QuickBooks, has had a strangle hold on the North American market for years now. They are no doubt the most well-known Accounting System among small business owners in Canada.

Intuit has poured a ton of resources into their cloud product and it really shows. They definitely know where the future lies. The User Interface (UI) looks better than ever and the app is just about as dashing and responsive as Xero’s for the most part.

The gap between Xero and QuickBooks Online (QBO) has definitely closed. One of previous major complaints about the product was that it was unable to connect properly to external third party apps. While this might not be important to some out there, it’s certainly important to us and to anyone else that wants a beautiful streamlined accounting system in place.

Leveraging the third party app ecosystem allows business owners to not only save time by putting more streamlined processes in place but to also improve visibility of their financial matters through the addition of more advisory oriented apps like Fathom (for KPI analysis) or Float (for cash flow projections). A year ago, QBO had almost no third party integrations. Today, they are matching Xero not in quantity but quality, as they have added some of the most popular apps to their marketplace. The integration points are not yet quite as strong as Xero’s, which translates in certain integrations not working as well as Xero’s, but I see this gap closing in due time as well.

Although QBO provides most of the same features that Xero provides (maybe even a little more), it’s clear that Intuit is in a transition phase between their wildly popular desktop product and their emerging cloud product as some of the interface in their online system is still a bit inconsistent, leading to a lessening of the overall experience.

On the plus side, QBO is far more regionalized than Xero, meaning, it’s a bit better configured straight out of the gate when it comes to matters like sales tax and check printing. The fact that Intuit has a physical presence in Canada (and a super cool team to boot!) means that this presence is felt in their product.

Additionally, QBO has basic payroll functionality baked directly into the app. You can calculate payroll deductions and have that information automatically entered into the Accounting System which is basic payroll functionality that Xero sorely lacks.

QBO has definitely raised their game when it comes to their online Accounting System. Expect them to keep pushing this as their go-to product.

Freshbooks

In our opinion, Freshbooks is not a direct competitor to the software listed above. Freshbooks is intended for a different market. If you’re a solopreneur, a consultant or a freelancer that has a non-incorporated business, then Freshbooks is probably a good match for you.

Out of the apps listed in this article, none of the others can touch Freshbooks in terms of its simplicity and that’s simply because Freshbooks is not a full blown Accounting System. Non-incorporated businesses do not require a full set of financial statements. They merely need to track revenues and expenses and Freshbooks does this with great ease. The app has barely any learning curve whatsoever as raising sales invoicing and logging business expenses is pretty straightforward.

There’s some nice automation possibilities as Freshbooks can connect to your business bank and credit card accounts to download transaction information as well as some pretty cool auto-billing functionality for those that want to setup recurring billing and invoicing once and never have to worry about it again.

What we sometimes do is connect Freshbooks to Xero when we need some more robust invoicing capabilities for incorporated business, especially for businesses that bill by the hour as Freshbooks has excellent time-tracking abilities.

Overall, Freshbooks is a very enjoyable product to use and we would recommend it for a non-incorporated business that simply needs to track revenues and expenses.

Which Software is Right for Your Business?

There are a ton of options out there when it comes to online Accounting Software and the list above is certainly not exhaustive. When it comes to selecting the right system, it’s always wise to test things out and to gain an understanding of what might be best Software for your business before implementing something as putting the wrong system in place could have the opposite effect of what one may be looking to accomplish. With the right system in place, you can shave hours each month off of your Accounting and receive visibility into your business like never before, so choose wisely before you go ahead and implement something.

If you are interested in hiring the Online Accounting and Tax Services from Accountable Business Services (ABS) absprof than Contact Us thru our contact details given below:

Contact Details

Accountable Business Services 9905 104 St NW T5K 2G5 Edmonton

Support Call: 1-888-556-7864

Fax Number: 780-669-7960

E-Mail: [email protected]

Website: https://absprof.com/

by ABS Professionals | May 9, 2015 | Blog

In Canada, small business ownership is the lifeblood of the country’s economy, just about every company is different from the next, given all the things that go into its development. But one thing that every business owner shares with the other is determining the type of business structure they’re going to be from a standpoint of classification.

For thousands of companies, Sole Proprietorship is the answer.

Were it not for Sole Proprietorship, Canada’s economy would be a shell of itself. According to Statistics Canada, Sole Proprietorships account for more than 50% of the nation’s annual gross domestic product, meaning that the majority of the country’s economic activity derives from businesses in this classification.

Were it not for Sole Proprietorship, Canada’s economy would be a shell of itself. According to Statistics Canada, Sole Proprietorships account for more than 50% of the nation’s annual gross domestic product, meaning that the majority of the country’s economic activity derives from businesses in this classification.

(more…)

by ABS Professionals | May 9, 2015 | Blog

Tax issues can be quite confusing. You could lose much of your hard-earned money without the assistance of Tax Preparation experts. If you are anticipating an easy way to plan your Taxes, then we can help. Accountable Business Services (ABS) is an Income Tax Return (T1 & T2) Preparation Services company located in Edmonton, Alberta; which prepares Income Tax (T1 & T2) Return through E-mail and Fax. Besides Edmonton we offer Income Tax (T1 & T2) Preparation Services in St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada on your Stargaze (Dream) Rate.

At Accountable Business Services (ABS), we provide consultation services to individuals as well as businesses through E-mail and Fax. Once you have choose our services, you can expect absolute peace of mind. The Income Tax (T1 & T2) Return expert at Accountable Business Services offers you practical solutions to downplay your Taxes (T1 & T2). We keep update ourselves with the latest CRA Tax laws to provide you with expert Income Tax (T1 & T2) Return Preparation Services through E-mail and Fax. Our staff are expert to accommodate the individual needs of our wide client base.

At Accountable Business Services (ABS), we provide consultation services to individuals as well as businesses through E-mail and Fax. Once you have choose our services, you can expect absolute peace of mind. The Income Tax (T1 & T2) Return expert at Accountable Business Services offers you practical solutions to downplay your Taxes (T1 & T2). We keep update ourselves with the latest CRA Tax laws to provide you with expert Income Tax (T1 & T2) Return Preparation Services through E-mail and Fax. Our staff are expert to accommodate the individual needs of our wide client base.

(more…)

by ABS Professionals | May 2, 2015 | Blog, Farm Taxes

On April 30, 2015, the Honourable Greg Dewar presented his first budget as Minister of Finance. The government will delay its plans to balance its budget in 2016-17, and will instead continue with spending in priority areas in order to invest in infrastructure, create jobs and strengthen services.

Highlights

Highlights

- Deficit of $424 million projected for 2014-15 (increased from $357 million deficit that was forecast last year)

- Deficit of $422 million forecast for 2015-16

- Balanced budget is predicted for 2018-19

- Small business limit increased

- Business tax credits enhanced or extended

Personal Tax Measures

Manitoba did not announce any changes to its personal income tax rates. As a result of changes to the gross-up factor and federal dividend tax credit rate that applies to non-eligible dividends announced in the 2015 federal budget, the combined Manitoba and federal tax rates for non-eligible dividends will increase between 2015 and 2019.

(more…)

by ABS Professionals | Apr 28, 2015 | Blog

Accountable Business Services (ABS) absprof provides a full range of Accounting, Bookkeeping and Tax Services geared towards assisting small to mid-sized companies. Our main objective is to help business owners like you reduce time spent on non-essential tasks, enabling you to focus on core business functions and increase profitability. Our advanced technical expertise differentiates ABS from other companies offering similar bookkeeping and accounting services.

We value the relationships we have established with our clients, including our work with other accounting firms. Our expert work hard to deliver timely and accurate data and reports, we also offer Free Financial Templates and Spreadsheet to Small Business Owners in Edmonton, St Albert, Strathcona County, Calgary, Red Deer, Lethbridge, Medicine Hat, Fort Mcmurray, Grande Prairie, Airdrie, Banff Canmore, Lloydminster and all over Canada; which is a Veritable (Authentic) Service.

(more…)

Our expert team of accounting and other financial services have decades of experience in the business (both corporate and proprietor/partnership) and financial services industry. We are able to draw from that experience to help your business become more efficient and make more money.

Our expert team of accounting and other financial services have decades of experience in the business (both corporate and proprietor/partnership) and financial services industry. We are able to draw from that experience to help your business become more efficient and make more money.

Generally speaking, partners commit an equivalent amount of their capital, or however much parties agree to, and in exchange, get a portion of the proceeds that the business makes in profit. They also agree to share whatever losses are experienced, in colligation with their stake in ownership.

Generally speaking, partners commit an equivalent amount of their capital, or however much parties agree to, and in exchange, get a portion of the proceeds that the business makes in profit. They also agree to share whatever losses are experienced, in colligation with their stake in ownership.

Most small business owners try and do it all themselves. This can happen for a number of reasons: limited income, unawareness that outside assistance is necessary, or the “I can do it all” mentality. One question we ask all potential clients is “Do you want your business to run you or do you want to run your business?” If the answer is that you want to run your business then we can guarantee you will need more than just the resources you have at hand to make it happen.

Most small business owners try and do it all themselves. This can happen for a number of reasons: limited income, unawareness that outside assistance is necessary, or the “I can do it all” mentality. One question we ask all potential clients is “Do you want your business to run you or do you want to run your business?” If the answer is that you want to run your business then we can guarantee you will need more than just the resources you have at hand to make it happen.

Were it not for Sole Proprietorship, Canada’s economy would be a shell of itself. According to Statistics Canada, Sole Proprietorships account for more than 50% of the nation’s annual gross domestic product, meaning that the majority of the country’s economic activity derives from businesses in this classification.

Were it not for Sole Proprietorship, Canada’s economy would be a shell of itself. According to Statistics Canada, Sole Proprietorships account for more than 50% of the nation’s annual gross domestic product, meaning that the majority of the country’s economic activity derives from businesses in this classification.

At Accountable Business Services (ABS), we provide consultation services to individuals as well as businesses through E-mail and Fax. Once you have choose our services, you can expect absolute peace of mind. The Income Tax (T1 & T2) Return expert at Accountable Business Services offers you practical solutions to downplay your Taxes (T1 & T2). We keep update ourselves with the latest CRA Tax laws to provide you with expert Income Tax (T1 & T2) Return Preparation Services through E-mail and Fax. Our staff are expert to accommodate the individual needs of our wide client base.

At Accountable Business Services (ABS), we provide consultation services to individuals as well as businesses through E-mail and Fax. Once you have choose our services, you can expect absolute peace of mind. The Income Tax (T1 & T2) Return expert at Accountable Business Services offers you practical solutions to downplay your Taxes (T1 & T2). We keep update ourselves with the latest CRA Tax laws to provide you with expert Income Tax (T1 & T2) Return Preparation Services through E-mail and Fax. Our staff are expert to accommodate the individual needs of our wide client base.

Highlights

Highlights