It’s no secret that many of you would rather squeeze your eyes out rather than spend one extra minute on your Accounting. It’s time-sucking, administrative and takes away from your focus on the big picture. With the correct tools in place whilst, you can make your life a whole lot easier.

Still stuck using some old, obsolete, frightful looking piece of desktop Accounting Software when managing your financial affairs? It’s time to upgrade. Let’s have a look at the best online Accounting Software for your small business.

Accountable Business Services (ABS) absprof wanted to give a brief update about what we feel is the best online Accounting Software for small businesses in terms of:

- Simplicity and ease of use

- Scalability (i.e. can your system grow with your business)

- Level of automation

- Amount of useful financial insight that can be derived

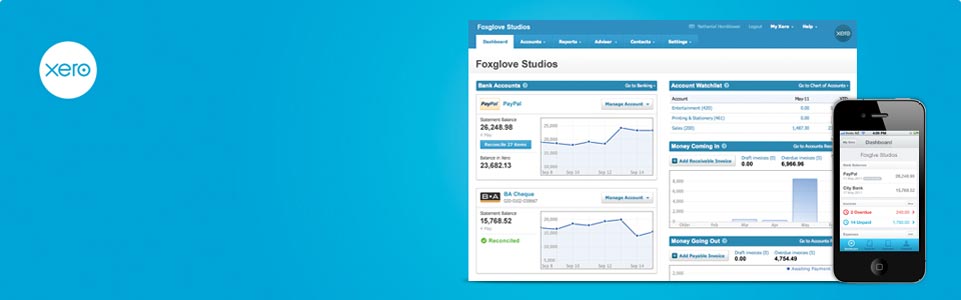

1. Xero

Xero’s appeal lies in its simplicity and in its ease of use. Does it have every single possible feature that an Accounting System should have? No. Xero was not designed to have a billion features. Instead, Xero was designed to act as a very strong core for all Accounting related functions.

For things that Xero cannot accomplish, it has a pretty deep marketplace of third party integrations that allows you to integrate different web apps into Xero. The benefit there is that you can come up with a pretty modular approach to your Accounting depending on what your business processes look like. Xero recognized that you can’t be everything to everyone and as such they focus on the perfecting the core Accounting functionality that every business needs. Anything that’s needed over and above that can likely be found via a third party app that would integrate into Xero. The cool thing about that is that you can always change your system as your business grows.

These days, everyone is trying to automate everything. Xero is no different in that they are trying to automate as much of the Accounting process as possible. By connecting to your bank and credit card accounts, much of the manual data entry can be eliminated as Xero automatically sucks in these transactions. Other automation features include automatically emailing out recurring invoices to clients, speeding up collections and automatically marking sales invoices as paid through a Stripe or Paypal integration, auto-reconciliation possibilities with certain transactions, creation of bank rules to automate transaction classifications and a whole lot more.

Additionally, from an Accounting point of view, the collaboration that we have with our clients is much easier through some of the features that Xero provides us with. We can have certain discussions in-app rather than having to go back and forth by email for instance. This interprets to increased time savings for businesses due to the voiding of email communication for more detail oriented items. Any time email can be eliminated, both parties come out happy.

Canadian businesses will have to settle for a global version of Xero, but with a bit of configuration, the system is perfectly suitable for Canadian purposes.

QuickBooks Online

Intuit, creator of QuickBooks, has had a strangle hold on the North American market for years now. They are no doubt the most well-known Accounting System among small business owners in Canada.

Intuit has poured a ton of resources into their cloud product and it really shows. They definitely know where the future lies. The User Interface (UI) looks better than ever and the app is just about as dashing and responsive as Xero’s for the most part.

The gap between Xero and QuickBooks Online (QBO) has definitely closed. One of previous major complaints about the product was that it was unable to connect properly to external third party apps. While this might not be important to some out there, it’s certainly important to us and to anyone else that wants a beautiful streamlined accounting system in place.

Leveraging the third party app ecosystem allows business owners to not only save time by putting more streamlined processes in place but to also improve visibility of their financial matters through the addition of more advisory oriented apps like Fathom (for KPI analysis) or Float (for cash flow projections). A year ago, QBO had almost no third party integrations. Today, they are matching Xero not in quantity but quality, as they have added some of the most popular apps to their marketplace. The integration points are not yet quite as strong as Xero’s, which translates in certain integrations not working as well as Xero’s, but I see this gap closing in due time as well.

Although QBO provides most of the same features that Xero provides (maybe even a little more), it’s clear that Intuit is in a transition phase between their wildly popular desktop product and their emerging cloud product as some of the interface in their online system is still a bit inconsistent, leading to a lessening of the overall experience.

On the plus side, QBO is far more regionalized than Xero, meaning, it’s a bit better configured straight out of the gate when it comes to matters like sales tax and check printing. The fact that Intuit has a physical presence in Canada (and a super cool team to boot!) means that this presence is felt in their product.

Additionally, QBO has basic payroll functionality baked directly into the app. You can calculate payroll deductions and have that information automatically entered into the Accounting System which is basic payroll functionality that Xero sorely lacks.

QBO has definitely raised their game when it comes to their online Accounting System. Expect them to keep pushing this as their go-to product.

Freshbooks

In our opinion, Freshbooks is not a direct competitor to the software listed above. Freshbooks is intended for a different market. If you’re a solopreneur, a consultant or a freelancer that has a non-incorporated business, then Freshbooks is probably a good match for you.

Out of the apps listed in this article, none of the others can touch Freshbooks in terms of its simplicity and that’s simply because Freshbooks is not a full blown Accounting System. Non-incorporated businesses do not require a full set of financial statements. They merely need to track revenues and expenses and Freshbooks does this with great ease. The app has barely any learning curve whatsoever as raising sales invoicing and logging business expenses is pretty straightforward.

There’s some nice automation possibilities as Freshbooks can connect to your business bank and credit card accounts to download transaction information as well as some pretty cool auto-billing functionality for those that want to setup recurring billing and invoicing once and never have to worry about it again.

What we sometimes do is connect Freshbooks to Xero when we need some more robust invoicing capabilities for incorporated business, especially for businesses that bill by the hour as Freshbooks has excellent time-tracking abilities.

Overall, Freshbooks is a very enjoyable product to use and we would recommend it for a non-incorporated business that simply needs to track revenues and expenses.

Which Software is Right for Your Business?

There are a ton of options out there when it comes to online Accounting Software and the list above is certainly not exhaustive. When it comes to selecting the right system, it’s always wise to test things out and to gain an understanding of what might be best Software for your business before implementing something as putting the wrong system in place could have the opposite effect of what one may be looking to accomplish. With the right system in place, you can shave hours each month off of your Accounting and receive visibility into your business like never before, so choose wisely before you go ahead and implement something.

If you are interested in hiring the Online Accounting and Tax Services from Accountable Business Services (ABS) absprof than Contact Us thru our contact details given below:

Contact Details

Accountable Business Services 9905 104 St NW T5K 2G5 Edmonton

Support Call: 1-888-556-7864

Fax Number: 780-669-7960

E-Mail: [email protected]

Website: https://absprof.com/