On April 30, 2015, the Honourable Greg Dewar presented his first budget as Minister of Finance. The government will delay its plans to balance its budget in 2016-17, and will instead continue with spending in priority areas in order to invest in infrastructure, create jobs and strengthen services.

Highlights

Highlights

- Deficit of $424 million projected for 2014-15 (increased from $357 million deficit that was forecast last year)

- Deficit of $422 million forecast for 2015-16

- Balanced budget is predicted for 2018-19

- Small business limit increased

- Business tax credits enhanced or extended

Personal Tax Measures

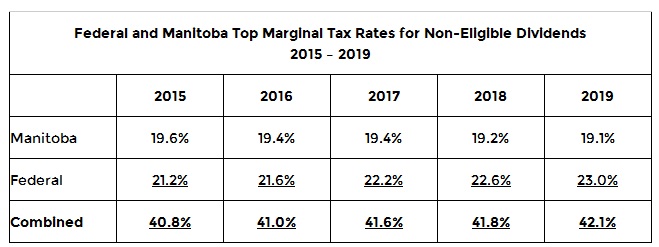

Manitoba did not announce any changes to its personal income tax rates. As a result of changes to the gross-up factor and federal dividend tax credit rate that applies to non-eligible dividends announced in the 2015 federal budget, the combined Manitoba and federal tax rates for non-eligible dividends will increase between 2015 and 2019.

The federal and Manitoba top marginal rates for non-eligible dividends are as follows:

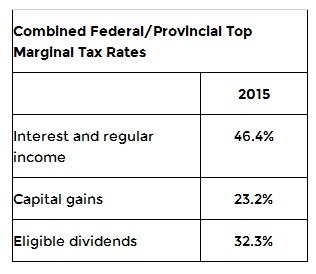

The combined federal and Manitoba top marginal tax rates on income other than non-eligible dividends for 2015 are as follows:

The combined federal and Manitoba top marginal tax rates on income other than non-eligible dividends for 2015 are as follows:

Primary Caregiver Tax Credit

Beginning in 2015, the Primary Caregiver Tax Credit is increased by 10% from a maximum annual amount of $1,275 to 1,400.

The tax credit was introduced in 2009 and enhanced in 2011, to provide recognition and financial supports to Manitobans who serve as volunteer primary caregivers to assist care recipients to live independently in their own homes.

One volunteer caregiver can claim up to 3 care recipients at one time, for a potential maximum annual tax credit of $4,200. The credit is claimed on the volunteer primary caregiver’s income tax return and is not income tested.

Community Enterprise Development Tax Credit

The budget extends the eligible investment period for the Community Enterprise Development Tax Credit to the first 60 days following the end of the calendar year, beginning January 1, 2015 for the 2014 calendar year.

As a result, a shareholder who makes an eligible investment through a qualifying trust that is a registered retirement savings plan can elect to retroactively claim the tax credit in the same taxation year as the deduction for the plan contribution.

Volunteer Firefighters’ and Search and Rescue Volunteers’ Tax Credits

The budget introduces a tax credit for eligible Manitobans who perform at least 200 hours of combined volunteer firefighting and volunteer search and rescue services in a year.

Starting in 2015, these individuals will be eligible to claim a 10.8% non-refundable income tax credit on an amount of $3,000. The maximum annual benefit is $324.

Senior’s School Tax Rebate

As announced on March 17, 2015, the maximum Senior’s School Tax Rebate will increase from $235 to $470 for the 2015 property tax year.

As well, the eligibility criteria for senior homeowners will be broadened to include seniors who occupy their principle residence and pay school taxes.

This change will benefit seniors who don’t own their residence but pay school taxes. In addition, a legal representative will be able to apply for the rebate on behalf of the senior homeowner.

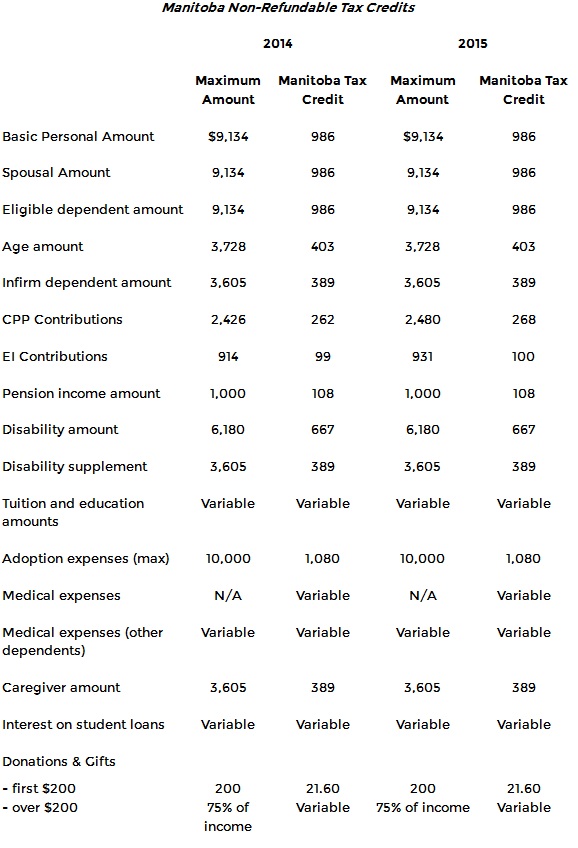

Personal Tax Credits For 2015

The maximum tax credits amounts and actual Manitoba tax credits for 2014 and 2015 are set out below:

In general, credits are multiplied by 10.8% to arrive at the deduction from Manitoba Tax. In the case of donations and gifts over $200, the credit is 17.40%

Corporate Tax Measures

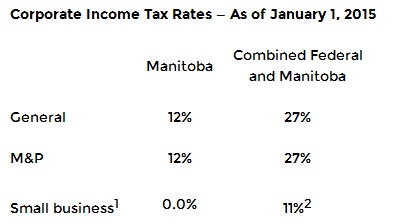

The budget did not announce any changes to the corporate tax rate.

As a result, Manitoba’s corporate income tax rates effective January 1, 2015 remain as follows:

(1) On the first $425,000 of active business income (increases to $450,000 on January 1, 2016)

(2) The 2015 federal budget will decrease the federal small business rate to 9% (from 11%) over 4 years, beginning January 1, 2016.

Small Business Income Threshold

The budget increases Manitoba’s small business income threshold for the small business deduction to $450,000 (from $425,000) on January 1, 2016.

Co-op Education and Apprenticeship Tax Credits (CEATC)

With the aim to promote more paid work and on-the-job training opportunities for students, today’s budget proposes to both enhance and expand the Co-op Students Hiring Incentive and the high school apprentice component of the CEATC.

The budget enhances the Co-op Students Hiring Incentive and “high school apprentice component” of the Co-op Education and Apprenticeship Tax Credit.

The budget expands eligibility for these fully refundable credits to include eligible employers who hire a student in a wide range of registered high school vocational programs that are not connected with the apprenticeship system (e.g., programs in health care, child care, business and hospitality).

This refundable tax credit for high school co-op students is worth 25% of eligible wages and salaries, up to a lifetime maximum of $5,000 per student.

The budget increases the benefits as follows:

- High school apprentices — 25% of wages and salaries (from 15%), to a maximum of $5,000 per apprentice per level

- Post-secondary co-op students — 15% of wages and salaries (from 10%), to a maximum of $5,000 per student

- Co-op graduates — 15% of wages and salaries (from 5%), to a maximum of $2,500 per graduate for the first two years of employment.

Community Enterprise Development Tax Credit

The budget proposes to extend the eligible investment period for the Community Enterprise Development Tax Credit to the first 60 days following the end of the calendar year, commencing January 1, 2015, with respect to the 2014 taxation year.

The credit was introduced in 2002 to encourage Manitobans to invest in local enterprises.

Qualifying investors receive a 45% refundable income tax credit on a maximum annual investment of $60,000 (up to $27,000 in tax credits). Eligible local enterprises can issue a maximum of $3,000,000 in qualifying investments.

This will allow a shareholder who makes an eligible investment through a qualifying trust that is an RRSP to elect retroactively to claim the tax credit in the same taxation year as the deduction for the related contribution.

Small Business Venture Capital Tax Credit

The budget enhances the non-refundable Small Business Venture Capital Tax Credit by increasing the maximum number of employees to 100 (from 50) and broadening the list of eligible business to include non-traditional farming ventures and brew pubs.

The credit is intended to encourage resident individuals and companies to acquire equity capital in emerging enterprises that require larger amounts of capital than community ownership can provide.

These changes take effect for eligible shares issued after April 30, 2015.

Data Processing Tax Credits

The budget broadens the Data Processing Investment Tax Credit and the Data Processing Equipment Investment Tax Credit to include new data processing centres built in Manitoba and leased to another Manitoba company that is not affiliated with the lessor and will be made available to taxpayers’ data processing centres built using a business structure other than a corporation.

The budget also extends the credits to the end of 2018 (from 2015). This refundable income tax credit is equal to 4.5% of the capital cost of new qualified property that is a building, and 8.0% of the cost of qualified machinery or equipment.

Both of these credits were set to expire on December 31, 2015.

In 2012 the Data Processing Investment Tax Credit was introduced as a means of positioning Manitoba as a high technology data processing location of choice.

In 2013, an additional credit, the Data Processing Equipment Investment Tax Credit, was introduced to encourage companies not currently engaged in data processing in Manitoba to make a significant incremental capital investment in data processing equipment in the province.

Research and Development Tax Credit

The budget extends the period for which unused Research and Development Tax Credits can be carried forward after they are earned to 20 years (from 10 years).

Corporations who carry on eligible scientific research and experimental development in Manitoba are eligible for a 20% Research and Development Tax Credit which can be applied against Manitoba corporate income tax payable in the year earned, with unused credits currently available for a 10 year carry forward and a 3 year carryback.

Green Energy Equipment Tax Credit

The budget expands the Green Energy Equipment Tax Credit to include biomass fuel energy equipment installed in Manitoba and used in a business. The tax credit rate will be 15%.

Corporation Capital Tax for financial institutions

The budget increases the Corporation Capital Tax on banks, trust corporations and loan corporations to 6% (from 5%), beginning for taxation years ending after April 30, 2015.

Credit Extensions

The budget extends the following existing tax credits:

- Manitoba Film and Video Production Tax Credit — Extended to the end of 2019 (from 2016)

- Rental Housing Construction Tax Credit — Extended to the end of 2019 (from 2017)

- Cultural Industries Printing Tax Credit — Extended to the end of 2018 (from 2015)

- Interactive Digital Media Tax Credit — Extended to the end of 2019 (from 2016)

- Nutrient Management Tax Credit — Extended to the end of 2018 (from 2015).

Other Measures (Not related to income tax)

Fuel Tax Rebate

The budget introduces a fuel tax rebate for qualifying commercial passenger flights that purchase fuel in Manitoba, effective July 1, 2015. To qualify, the commercial passenger flight must be regularly scheduled and fly non-stop to a destination outside North America after departing from Manitoba.

Tobacco Tax

- The budget increases the Tobacco Tax rate effective midnight, April 30, 2015. The rate will increase:

- Per cigarette — 29.5 cents (from 29.0 cents)

- Fine-cut tobacco — 28.5 cents per gram (from 28.0 cents)

- Raw leaf tobacco — 27.0 cents per gram (from 26.5 cents)

Sales Tax

- Effective June 1, 2015, the budget makes changes to the sales tax rules to:

- Expand the exemption for flood prevention and control supplies to include sandbag filling machines

- Expand the exemption for commercial fishing boats to include related repair parts

- Clarify that the exemption for goods designed solely for use by a disabled person applies to both physical and mental

- Expand the exemption for film and audio productions for public broadcast to include online video or audio content.

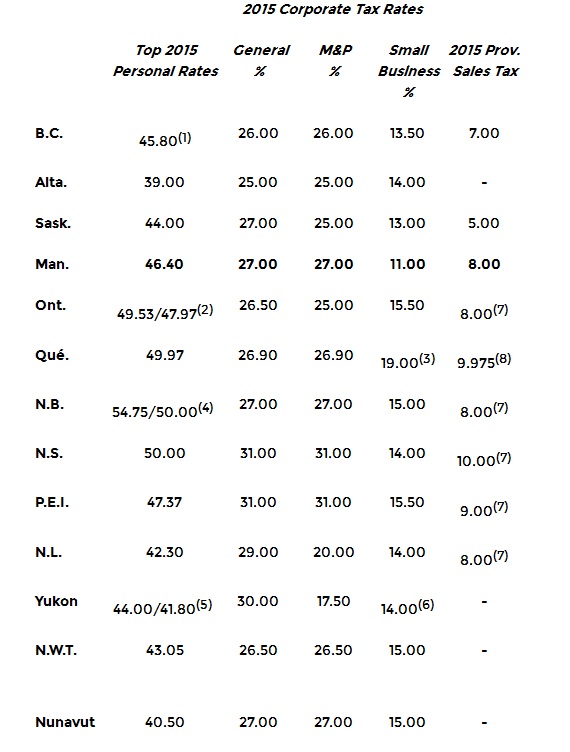

How Manitoba Compares

The following chart compares top personal and corporate tax rates and sales taxes for all provinces and territories, as announced to April 30, 2015.

- A temporary top personal income tax bracket with a rate of 16.8% was introduced for 2014 and 2015 and applies on taxable income in excess of $151,050.

- The top rate includes the additional tax on taxable income in excess of $220,000. The combined tax rate on regular taxable income over $150,000, but not exceeding $220,000 is 47.97%.

- Quebec provides a rate reduction for manufacturing SMEs. Where certain conditions are met, the maximum reduction available is 2%, for a combined rate of 17%. Effective April 1, 2015, the maximum reduction will increase to 4% for a combined rate of 15%. Note that a lessor reduction may be available to certain manufacturing SMEs where not all conditions are met.

- The top rate includes the additional tax on taxable income in excess of $250,000. The combined tax rate on regular taxable income over $150,000 but not exceeding $250,000 is 50%.

- The top rate includes the additional tax on taxable income in excess of $500,000. The combined tax rate on regular taxable income over $138,586 but not exceeding $500,000 is 41.80%.

- The tax rate for M&P profits eligible for the small business deduction is 12.5%.

- As part of the HST (combined rates are 15% in Nova Scotia and 14% in Prince Edward Island and 13% in Ontario, New Brunswick and Newfoundland & Labrador).

- The QST system is harmonized with the GST, though two separate tax systems remain – the GST and the amended QST.

(Source: Manitoba Government)